Discuss the advantages and disadvantages of different econometric strategies used to identify and estimate causal effects, including: Differences-in-Differences First differences Instrumental Variables. Describe different ways of deriving and interpreting the OLS estimators (estimates) for the parameters of a linear regression model, among: Minimizing the sum of the squared residuals Method of moments & Sample analog principle Maximizing the likelihood function. Name and discuss the main consequence(s) of the failure of each assumption, illustrating with specific microeconomic examples or applications. State the assumptions of the classical linear regression model and explain their roles within the Gauss-Markov Theorem. Explain their differences and similarities. Recognize different types of econometric data among: cross sections, time series, pooled cross sections, and panel/longitudinal data. Explain key differences and links between distinct but related econometric concepts, for instance “econometric model and estimation method ” “population and sample ” “population parameter, estimator, and estimate ” “correlation and causal effect ” “error term and residual ” “point estimate and confidence interval ” “significance level and critical value ” “proxy variable and instrumental variable.”. Define key concepts in econometrics, for instance “econometric model” “random sample ” “ceteris paribus ” “counterfactual ” “causal effect ” “exogeneity/endogeneity ” “homoskedasticity/heteroskedasticity ” “restricted/unrestricted model ” “finite-sample/asymptotic bias ” “omitted variables bias ” “dummy variable trap.”. (Logit and Probit Maximum Likelihood Estimation). Limited dependent variable (LDV) models with binary dependent variables. Instrumental variables (IV) estimation and Two stages least squares (2SLS). (Differences-in-Differences First Differencing). Pooling cross sections across time: Simple panel data methods. (Heteroskedasticity-robust standard errors Weighted Least Squares (WLS) estimation Feasible Generalized Least Squares (FGLS) estimation. Heteroskedasticity of known and unknown forms. Dummy dependent variables and the linear probability model). (Use of dummy explanatory variables and their interactions to the aims of incorporating qualitative or ordinal information in regression analysis and of performing tests of hypothesis and policy analysis involving comparisons of groups. Multiple regression analysis with qualitative information: Dummy variables.

(Properties of OLS estimator in infinite samples). Multiple regression analysis: OLS asymptotics.Confidence intervals Tests of simple and multiple hypotheses about population parameters).(Distribution of OLS estimator in finite samples. Multiple regression analysis: Inference.(Motivation for multiple regression Mechanics and interpretation of OLS Expected value and variance of OLS estimator Gauss-Markov Theorem and Efficiency of OLS estimator). Multiple regression analysis: Estimation.

(Definition Multiple ways of deriving the Ordinary Least Squares (OLS) estimates Properties of OLS in any sample of data). (What is Econometrics? Steps in empirical economic analysis The structure of economic data Causality and the notion of ceteris paribus in econometric analysis).

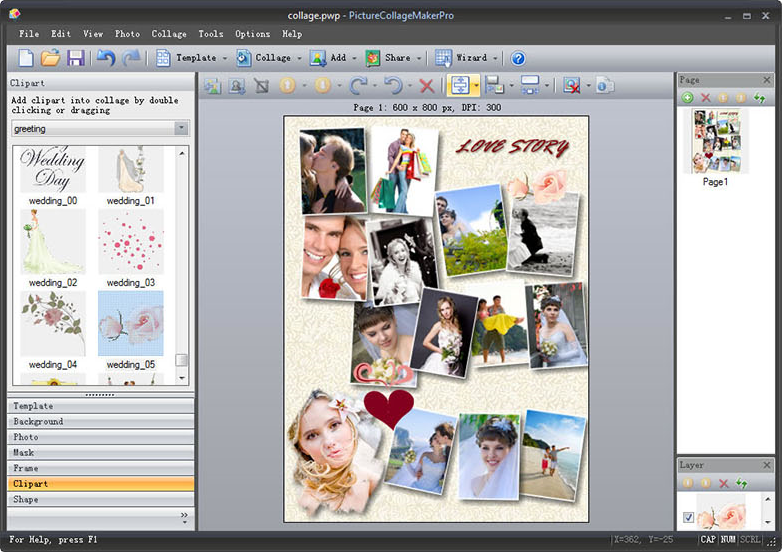

#Pics collage maker free download how to#

As part of the course, students also receive an introduction on how to conduct empirical analysis of economic data using Stata, a statistical software package.

The key concepts of the underlying statistical theory is covered, but major emphasis is placed on application of the theory from a practical standpoint. The main goals of this course are: (i) to give students a working knowledge of the most important aspects of the linear regression model (ii) to provide students with basic tools needed to understand and critically interpret empirical research conducted by others as well as to plan and conduct empirical analyses of their own using economic data. Knowledge of the linear regression model and its extensions is essential for doing empirical work in economics, business, and other social sciences. It has been (and continues to be) the most common starting point in econometric studies. One of the most popular statistical frameworks in econometrics is the linear regression model. Econometrics is the art of taking a theoretical economic model and placing it into a statistical framework where data is used for the purposes of prediction, measurement, and/or testing of economic theory.

0 kommentar(er)

0 kommentar(er)